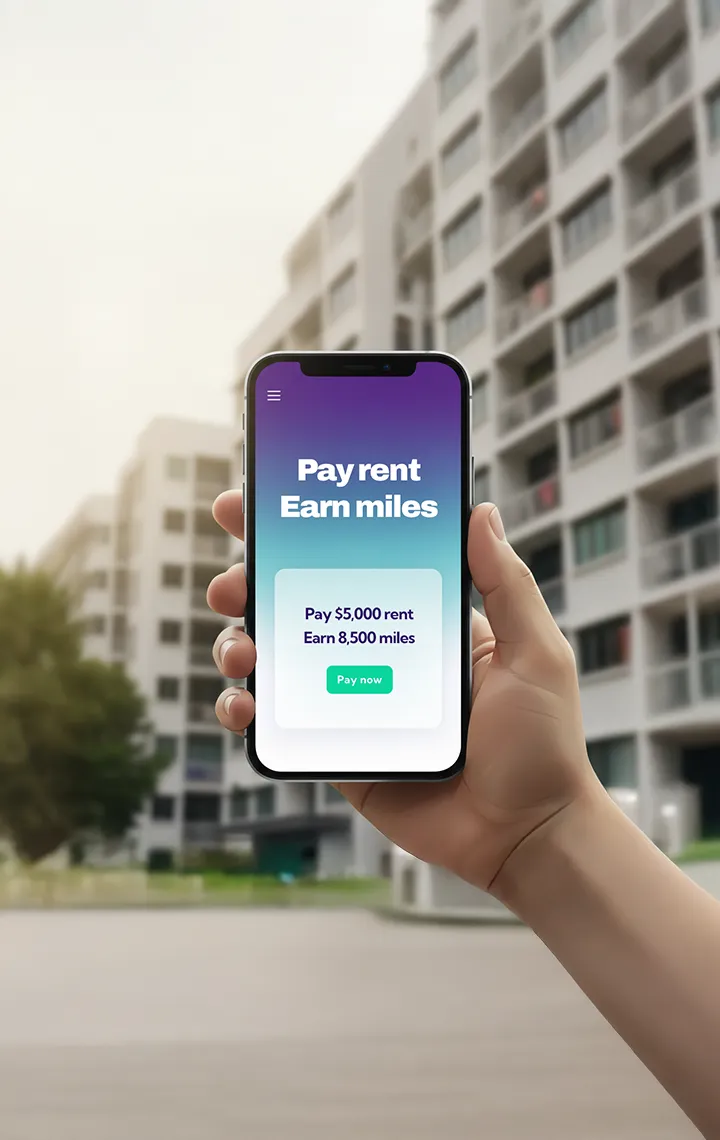

For many tenants in Singapore, rent is the largest recurring expense. With monthly payments easily ranging between $1,500 and $6,000, it’s natural to ask:

“Can I pay rent with a credit card in Singapore and earn rewards from it?”

The short answer is yes. And not only is it possible — it can be an extremely rewarding strategy when done correctly. Thanks to modern rent payment platforms and bank-operated services, tenants can now turn their biggest monthly bill into air miles, cashback, and flexible rewards.

In this guide, you’ll learn exactly how to pay rent with a credit card in Singapore, the fees involved, the best cards to use, and how to maximise the value of every rent payment. We’ll also explain why tenants who pay rent with Rently can earn double rewards from the same transaction.

Can You Pay Rent with a Credit Card in Singapore?

Most landlords in Singapore still don’t accept credit cards directly. They prefer PayNow, bank transfers, or GIRO, which are simple and free. Credit card terminals are uncommon among individual landlords, and few will absorb the associated processing fees.

This means that if you want to use your credit card for rent, you need an intermediary — a platform that charges your card, then pays your landlord via bank transfer. These services have existed for years but have become more mainstream as tenants increasingly look to earn miles, cashback, and sign-up bonuses.

Today, tenants can pay rent with a credit card in Singapore using:

1. Third-party rent payment platforms

Such as Rently, CardUp, ipaymy, and RentHero. These platforms charge your credit card and forward the rent to your landlord through a normal bank transfer.

2. Bank-operated payment facilities

Such as Citi PayAll and Standard Chartered EasyBill. These let tenants charge certain bills — including rent — directly through the bank’s app.

Both methods involve fees. Whether those fees are worthwhile depends on two factors: your credit card rewards strategy and how effectively you redeem the miles or points you earn.

How Third-Party Rent Payment Platforms Work

Platforms like Rently, CardUp, and ipaymy work by placing themselves between your credit card and your landlord. You set up the rent amount, add your landlord’s bank details, and schedule your payment. The platform charges your credit card and sends the corresponding amount to your landlord.

Nothing changes on your landlord’s side — they receive the rent as a standard bank transfer.

These platforms typically charge between 1.75% and 2.6%, depending on card type and promotions. In exchange, tenants receive miles, cashback, or points from their credit card issuer.

For years, this was the entire experience: pay rent, earn your card’s rewards, pay a fee.

Why Paying Rent with Rently Offers More Value

While Rently operates similarly to other platforms, it introduces two major features that give tenants more control and more value: double rewards and lower-fee eGIRO.

1. Pay rent with Rently using your credit card and earn double rewards

Rently is the only platform in Singapore that lets tenants earn two reward currencies at the same time:

Your credit card miles or points, and

Max Miles, a flexible rewards currency that converts 1:1 into 30+ top airline and hotel programmes

This means one rent payment earns:

KrisFlyer miles (if your card supports it), and

Max Miles that can be transferred to carriers like Qatar, Qantas, United, or hotel chains like Hyatt and IHG

No other rent payment platform in Singapore offers this kind of stacked rewards model.

2. Or pay rent with Rently via eGIRO for lower fees

Rently is also the only platform in this category that offers eGIRO, a bank-to-bank automated payment option with lower fees than credit card payments.

This gives tenants flexibility every month:

Want maximum miles? Pay by credit card.

Want minimum fees? Switch to eGIRO.

Other platforms only support credit card payments, meaning tenants must always pay the higher fee.

Bank-Operated Credit Card Payment Facilities

Banks such as Citibank, Standard Chartered, UOB, and DBS offer bill payment services that let tenants charge rent to their credit card through the bank’s app.

These tools are convenient, and banks often run targeted promotions on fees or bonus miles. However, bank facilities come with important limitations:

You earn only your bank card’s rewards

There is no extra rewards layer like Max Miles

You cannot choose lower-fee eGIRO

You are locked into one bank’s ecosystem

You cannot switch between different credit cards for optimisation

They work well for simplicity, but for rewards maximisation, third-party platforms generally offer better flexibility.

Are the Fees Worth It? How to Evaluate Value When Paying Rent by Credit Card

Every credit card rent payment comes with a fee, so the key question is whether the rewards justify it.

Here’s a straightforward example:

Rent: $2,500

Fee: 2% → $50

Card earn rate: 1.2 miles per dollar

Miles earned: 3,000 miles

Approximate value of miles (~1.5 cents each): $45

At face value, you’re almost breaking even.

But when you pay rent with Rently, you earn additional Max Miles, which often pushes the total rewards value well above the fee.

Credit card rent payments become especially valuable when:

You’re hitting a card sign-up bonus

You’re aiming for annual spend tiers

You want to quickly accumulate miles for a big redemption (e.g., business class)

You want flexible points you can redeem across airlines and hotels

When used strategically, the rewards can easily outweigh the cost.

The Best Credit Cards for Paying Rent in Singapore

The ideal credit card for rent payments depends on your reward preferences, but most tenants find that miles cards offer the highest value.

Strong candidates usually offer:

1.2–1.6 miles per dollar on local spend

Clear eligibility for third-party payment platforms

Attractive sign-up bonuses

Access to multiple airline transfer partners

Cashback cards can work, but many exclude MCC categories used by rent payment platforms — so check the latest T&Cs.

For many tenants, the real power lies in using rent to meet minimum spend thresholds during the first few months after a card application. The bonus miles earned often dwarf the processing fees.

Why Paying Rent With Rently Is a Smart Travel Rewards Strategy

Paying rent with a credit card typically gives tenants one rewards currency. Paying rent with Rently gives tenants two, which opens the door to far more redemption possibilities.

Max Miles act as a flexible global currency. Because they transfer 1:1 into more than 30 airline and hotel partners, they enable tenants to:

Redeem business and first-class flights

Access award chart sweet spots unavailable in Singapore-based programmes

Book high-value hotel stays

Avoid being locked into a single airline

Hedge against programme devaluations

Tenants effectively build a portfolio of travel rewards, not just a single points balance.

How to Maximise Rewards When Paying Rent

To make your rent work harder for you, follow a simple strategy:

Choose a strong miles card that earns on payment platforms

Use rent payments to hit sign-up bonuses

Pay rent with Rently via credit card if you want to maximise rewards

Pay rent with Rently via eGIRO if you want to minimise fees

Always pay your card bill in full to avoid interest costs

This approach ensures you optimise rewards while maintaining healthy financial habits.

Step-by-Step: How to Pay Rent With Rently

Create your account on rently.sg

Upload your signed tenancy agrement and landlord’s bank details

Select your preferred payment method (credit card or eGIRO)

Review the fee and payout amount

Confirm your payment

Pay rent on time and conveniently every month, and watch the rewards roll in!

In just a few steps, your rent becomes a monthly opportunity to earn rewards.

Who Benefits Most from Paying Rent with a Credit Card?

Tenants who stand to gain the most include:

Frequent travellers

High-income professionals and expats

Anyone collecting miles for premium flights

Tenants optimising card rewards

Those chasing sign-up bonuses or annual spend tiers

If you value flexibility and premium travel experiences, card-based rent payments — especially through Rently — can deliver exceptional value.

Conclusion: Turning Rent Into Rewards in Singapore

Paying rent with a credit card in Singapore has evolved from a niche miles-hacking move into a mainstream rewards strategy. Whether you choose a bank facility or a third-party platform, you can now earn meaningful rewards from your largest monthly expense.

But for tenants who want both maximum rewards and payment flexibility, paying rent with Rently stands out:

Credit card rewards + Max Miles (double rewards)

eGIRO for lower fees

Access to 30+ global airline and hotel partners

Secure, automated rent payments that keep your landlord happy

If you’re already spending thousands on rent each month, it makes sense to let that money work harder for you.

Start Earning Rewards on Your Rent Today

By choosing to pay rent with Rently, tenants can:

Earn miles or points on their preferred credit card

Collect Max Miles for premium global travel

Automate monthly payments with credit card or eGIRO

Turn rent into a steady source of rewards