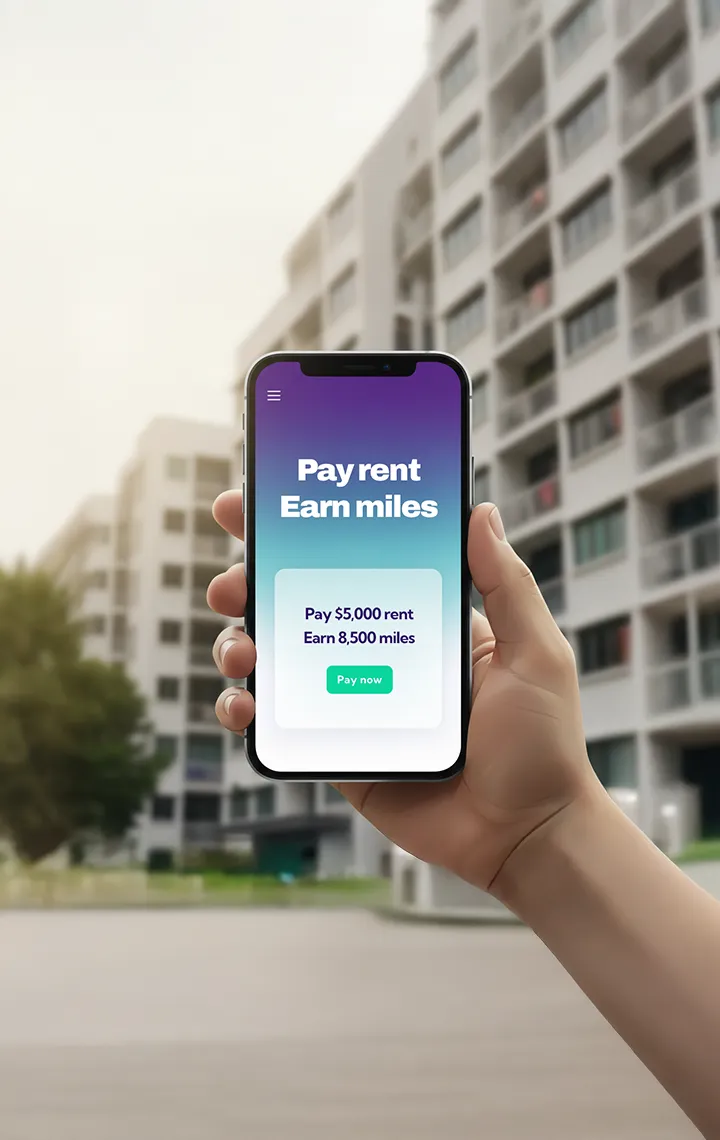

If you’re paying rent every month, here’s the painful truth: you’re probably not getting anything back from it. It’s just money leaving your account. Painful, boring, gone.

But here’s the fun twist. What if I told you that rent…yes, the same rent you grumble about could actually fund your next flight, upgrade your credit card game, and give you a nice little flex at dinner with your friends? That’s exactly what RentlyPay does.

Let me break it down for you.

The Old Way vs The Smart Way

The Old Way:

You manually transfer money to your landlord every month.

You get zero perks, no cashback, no miles.

You stress about whether you sent it on time.

The Smart Way (aka RentlyPay):

You pay rent through RentlyPay.

Your rent gets turned into points, miles, or cashback depending on your setup.

Everything’s automated. You set it once, and it’s on autopilot.

In short: rent goes out, but benefits come back in.

Why Reward Seekers Love This

If you’re the kind of person who checks credit card promos, stalks KrisFlyer deals, or gets a little thrill seeing your miles balance grow, this is your playground.

Here’s what happens:

Pay rent with your credit card (yes, even if your landlord doesn’t accept cards).

Earn your usual credit card miles plus extra bonuses through RentlyPay’s HeyMax integration.

Suddenly, your rent isn’t just paying for four walls, it’s paying for flights, hotels, and status upgrades.

Think about it: if your rent is $3,500 a month, that’s $42,000 a year. At 1 mile per dollar, you’re looking at 42,000 miles minimum. That’s already a return trip to Tokyo in business class if you time it right. And that’s just one year.

But Wait, Is It Complicated?

Not at all. That’s the beauty. RentlyPay uses eGIRO and card setups behind the scenes to make the payments smooth. Your landlord gets the rent directly like any normal transfer. You just get the perks.

No awkward conversations with your landlord. No extra apps. No Excel tracking. It’s literally “set it, forget it, earn from it.”

Why This Isn’t Just About Miles

Of course, the headline is the rewards. But there’s also:

Cash flow control – You can decide whether to charge to your card (hello, extra float time).

Peace of mind – Automated payments mean no more “oops I forgot rent” moments.

Flexibility – Whether you want miles, cashback, or points, the system works with you.

Here’s the thing no one tells you: your rent is probably your single biggest monthly expense. If you’re not getting something back from it, you’re leaving serious money on the table.

Think of RentlyPay as your little hack. Your landlord gets paid. You rack up rewards. And the next time you book a flight or cash out points, you can smugly think: “My rent paid for this.”